This Project Is a Review of the Accounting Cycle That Has Been Covered During Class

Overview

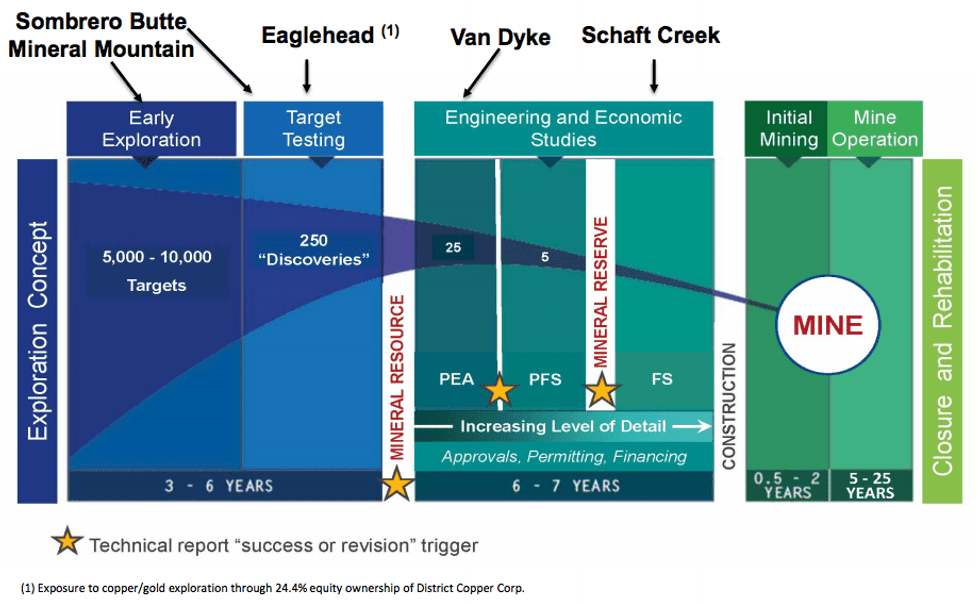

Copper Fox Metals Inc. (TSXV:CUU,OTC Pink:CPFXF) is a Canadian resource development company focused on value cosmos through the acquisition, exploration and evolution of potentially low-toll, large polymetallic porphyry copper projects in Due north America. The visitor holds a 25 percent carried interest in the Schaft Creek joint venture project with Teck Resources Limited (TSX:B) in British Columbia and a 100 percent interest in three additional projects in the Usa.

According to the United states Geological Society, copper is the third virtually consumed industrial metal in the earth. The red metal is well known for its high ductility and electrical electrical conductivity, making it an important function of the renewable energy and electrical vehicle (EV) revolutions. Global copper demand reached 23.6 one thousand thousand tons in 2018 and is expected to reach 30 million tons by 2027, according to an commodity by Forbes. Nevertheless, analysts are predicting that supply is non going to be able to proceed upward with need, making it essential for new projects to be put into product.

With this in mind, Copper Fox is focusing its efforts on its advanced-stage copper projection, more specifically, the Schaft Creek copper projection in British Columbia. The project has a 2013 feasibility report that outlines a proven and likely mineral reserve of 940.8 1000000 tonnes grading 0.27 percent copper, 0.19 g/t aureate, 0.18 percent molybdenum and 1.72 thou/t argent. The feasibility written report forecasts annual production of 105,000 tonnes of copper, 201,000 ounces of gold, 1.ii million ounces of silver and 10.ii million pounds of molybdenum once the property is put into product.

The Schaft Creek joint venture (SCJV) is investigating a 133,000 tonne per day mining scenario at the Schaft Creek project. The SCJV has defended C$2.1 meg to merchandise-off studies related to that mining scenario including a review of the permitting and environmental requirements needed for the 133,000 tonnes per day scenario equally well as new engineering improvements and collecting additional baseline environmental data.

Adjacent in the visitor's project pipeline is the evolution of the Van Dyke copper project in Arizona. Copper Fox released a preliminary economic assessment (PEA) in November 2015 that returned several recommendations for optimizing the project'southward economics. In March 2020 the company appear the results of an updated resource estimate for the project that was prepared by Moose Mountain Technical Services. Highlights of the resources gauge include 97.6 million tonnes, grading 0.33 percent total copper and 0.24 pct total recovered soluble copper containing 717 million pounds of total copper and 517 one thousand thousand pounds of recoverable soluble copper in the indicated category.

Copper Fox is also advancing its exploration-stage Mineral Mountain and Sombrero Butte copper projects in Arizona. Both projects reside in well-defined major porphyry copper belts in Arizona that host large porphyry copper deposits, such as the Resolution, Ray, San Manuel and Kalamazoo deposits.

Copper Pull a fast one on also owns 24.4 per centum of the issued and outstanding shares of Commune Copper Corp. (TSXV:DCOP), providing its shareholders with exposure to a gold project in Newfoundland. In early 2019, District Copper diversified its project portfolio by acquiring the Stony Lake gold project in Newfoundland. The visitor too owns the Eaglehead copper-molybdenum-gold project in British Columbia, which has recently been placed on intendance and maintenance.

Company Highlights

- Copper Fox'south focus is on projects that maximize asset value per dollar spent.

- Balanced belongings portfolio ranging from exploration to avant-garde-stage evolution projects.

- The company is focused on large, low-cost copper projects in proven copper districts in N America.

- 25 percent carried interest in the advanced-phase evolution project, Schaft Creek. Teck Resources Limited holds the remaining 75 pct interest in the project and is the project operator.

- Copper Play a joke on has a 100 percent interest in the Van Dyke project, an advanced-phase in-situ leach ("ISL") copper project.

- The 2020 resource estimate at Van Dyke includes 97.half-dozen meg tonnes, grading 0.33 percent total copper and 0.24 percent full recovered soluble copper containing 717 million pounds of full copper and 517 meg pounds of recoverable soluble copper in the indicated category

- A pre-tax internet nugget value of approximately C$423 million based on NI 43-101 technical reports for the Schaft Creek and Van Dyke deposits.

- Copper Pull a fast one on owns a 24.four percent involvement in Commune Copper, providing its shareholders with exposure to an additional copper project in British Columbia and a golden project in Newfoundland.

- Proven direction team with the ability to develop projects.

Key Projects

Schaft Creek Joint Venture Project — British Columbia

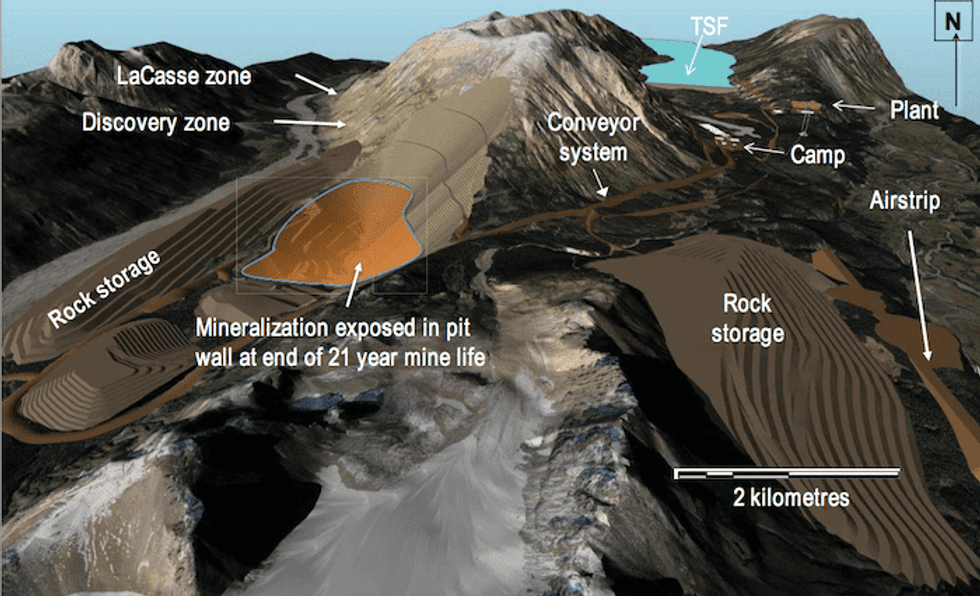

The Schaft Creek project is an advanced stage porphyry copper-gilded-molybdenum-silver project in northwest British Columbia. The project comprises approximately 55,779.56 hectares in the Cassiar-Liard mining partition located 278 kilometers from the Port of Stewart, Due north America's closest deep-water seaport to Communist china.

In July 2013, Copper Fox and Teck executed a joint venture understanding whereby Copper Play a trick on holds a 25-percent carried interest in the Schaft Creek Joint Venture (SCJV) and Teck holds 75 per centum along with operatorship. Since 2013, the SCJV completed boosted geotechnical studies, diamond drilling, collected environmental baseline data and an updated geological model for the project.

First discovered in the late 1950s, Schaft Creek has an extensive exploration history including the completion of 444 drill holes totaling 108,459 meters. The deposit contains three mineralized zones: the Liard zone (also referred to equally the Main zone), the West Breccia zone and the Paramount zone.

2013 Feasibility Study

Copper Play a joke on completed a feasibility study on the belongings in January 2013. Highlights of the study include:

- Initial mine life of 21 years at a milling charge per unit of 130,000 tonnes per day – open pit mine at 2:ane strip ratio;

- Initial capital cost of $3.26 billion, which includes contingencies of $374 one thousand thousand;

- Proven and likely mineral reserves total 940.8 meg tonnes grading 0.27 per centum copper, 0.19 g/t gold, 0.018 percent molybdenum and 1.72 yard/t silver containing 5.6 billion pounds of copper, five.8 million ounces of gold, 363.5 million pounds of molybdenum and 51.vii meg ounces of silvery;

- The NPV and IRR of the project are well-nigh sensitive to the foreign exchange (FOREX) followed past the price of copper. A FOREX of C$0.97 and US$1 was used in the feasibility study;

- 1 pct point change in the FOREX increases the project NPV past United states$75 1000000 (discounted at eight percent) over the life of mine;

- The project has positive NPV and IRR;

- Five-yr, pre-production menses (includes permitting, road, power line and facilities construction);

- The feasibility study also identified a number of enhancements that could meliorate the economics of the project.

The feasibility study was based on a proven and likely reserve of 940.eight million tonnes grading 0.27 percent copper, 0.nineteen k/t gold, 0.18 percentage molybdenum and 1.72 grand/t silver, containing 5.6 billion pounds of copper, five.vii million ounces of gold, 363.5 million pounds of molybdenum and 51.7 million ounces of silver. From this, Copper Flim-flam expects annual production of 105,000 tonnes (232 million pounds) of copper, 201,000 ounces of gold, i.2 million ounces of silverish and ten.2 million pounds of molybdenum over the life of mine.

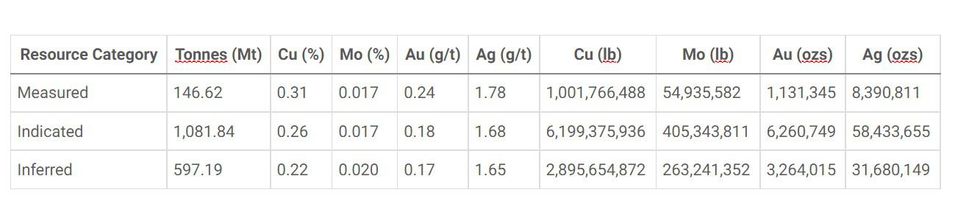

The feasibility study also included a measured and indicated resource of 1.two billion tonnes grading 0.26 per centum copper, 0.017 percent molybdenum, 0.xix g/t gold and i.69 chiliad/t silver and an inferred resource grading 0.22 per centum copper, 0.016 percent molybdenum, 0.17 k/t gold and one.65 g/t silverish. The proven and probable reserves are included in the measured and indicated resource.

Technical Studies

In 2014, the SCJV commenced a series of optimization studies to advance the project, including metallurgical, pit slope design, geological modeling and environmental monitoring. Fieldwork conducted at this time led to the discovery of the copper-golden mineralization in the LaCasse zone.

In 2015, the SCJV completed studies that were focused on daily throughput rates, mine and infrastructure planning, water management, updating the resource model and tailings storage. Optimization studies also included a comminution study to determine power requirements, milling chapters and circuit pattern, Geomet Unit definition, generation of new Whittle pits and training of mine schedules.

The SCJV likewise completed re-logging approximately 43,000 meters of drill core from the Schaft Creek deposit. The company likewise completed surface mapping and geochemical and geophysical surveys on the property that identified several new exploration targets to the north and south of the eolith.

The Conceptual infrastructure of Schaft Creek deposit based on 2013 feasibility report

The following year, the SCJV used drilling results from 2013 and re-logged drill cadre information to update that resource model for the Schaft Creek deposit with an emphasis placed on better understanding the controls on the copper and precious metals. In 2017, the SCJV completed resource remodeling, desktop engineering and merchandise-off studies, collection of environmental baseline data, applied for a multi-year surface area-based permit and engaged in social activities with the Tahltan Nation.

The positive upshot of the 2017 work plan formed the basis of the 2018 sizing and infrastructure culling study. The study investigated four sizing scenarios targeting capital, operating and sustaining cost reductions, a college-course initial starter pit and other ways to meliorate project economics. The final written report suggested that a 133,000 tonnes per day scenario should be selected for in-depth study in 2019.

In 2019, the SCJV dedicated C$ii.1 million to evaluate the identified technology improvement options further to reduce capital and operating costs assuming the 133,000 tonnes per twenty-four hour period throughput case. The 2019 program besides includes a review of the site characteristics of potential revisions to primal infrastructure elements, such as tailing storage, conveyance systems, ore and waste send options and manufactory location based on a 133,000 tonnes per 24-hour interval throughput instance.

Van Dyke Copper Project – Arizona

Copper Fob holds a 100-percent interest in the ane,312.8-acre Van Dyke in-situ leach (ISL) copper project. The property is located in the Globe-Miami mining district, 90 miles eastward of Phoenix, Arizona. The commune is located forth the Globe-Miami and Casa Grande structural trend, which hosts the Casa Grande, Florence, Ray, Resolution and Globe-Miami copper deposits.

The Van Dyke copper deposit is located within the Earth-Miami mining commune, which hosted four principle orebodies: Alive Oak, Thornton, Miami Caved and Miami Eastward. The belongings was kickoff explored and developed in the early 1900s. Betwixt 1929 and 1945, the Van Dyke property was in production and reportedly produced 11.viii million pounds of copper with a course of five percentage copper.

2015 PEA and Resource Gauge

In January 2015, Copper Play a trick on completed a NI 43-101 resource estimate for the project reporting an inferred resource guess of 261.7 million tonnes grading 0.25 percent copper at a 0.05 percentage copper cut-off (estimated ane.44 billion pounds of copper) and completed a PEA for the Van Dyke deposit in December 2015.

The 2015 PEA is the beginning NI 43-101 applied science technical report completed on the project and suggests that Van Dyke is a technically sound ISL copper projection, using underground admission, conventional solvent extraction and electrowinning (SX-EW) recovery methods with low cash costs, potent greenbacks flows and an after-revenue enhancement internal rate of return (IRR) of 27.nine percent.

2015 PEA Highlights (based on US$3 per pound copper):

- Gross revenue of U.s.a.$1.37 billion over 11-year life of mine;

- Cumulative net costless cash menses after recovery of initial majuscule costs of US$453.one million before tax and US$342.ii million after-revenue enhancement;

- Net gratis cash period within the first six years is approximately US$72 million per twelvemonth before tax, declining after that;

- LOM directly operating toll of US$0.60 per pound copper;

- Product plan of lx meg pounds of copper within the first six years, declining thereafter;

- Initial capital cost (including pre-product costs) totals United states$204.4 million, including contingencies of United states of america$42.4 million;

- LOM soluble copper recovery estimated at 68 percent with acid consumption of 1.5 pounds of acid per pounds of copper produced;

- After-tax payback of initial capital letter in iii.9 years.

"The PEA has fulfilled its purpose and indicates that the project warrants more detailed testing and engineering," said Stewart. "The PEA has identified several aspects that, with positive results from the updated resource estimate along with additional testing and engineering, could extend the mine life and significantly increase project economic science, indicating that Van Dyke could become a stiff project in the mid-size copper development space."

The 2015 PEA identified several aspects of the project that could accept a positive bear on on the project'due south economics. The report also recommended that a pre-feasibility study should be completed to move the project forward.

Exploration

Between 1968 and 1980, Occidental Minerals Corporation drilled 70 exploration holes (62 of which encountered measurable copper mineralization) on the Van Dyke property. Forty-half dozen of these were used to estimate a historical resource of 112 million tons at a course of 0.52 pct copper. Occidental also conducted 2 ISL tests on the Van Dyke oxide copper deposit. Results of Occidental's ISL tests were positive.

In July 2014, Copper Fox completed a six-hole (3,211.vii-meter) verification diamond drill program on the Van Dyke oxide copper deposit. All half dozen drill holes intersected oxide copper mineralization over broad intervals with the soluble copper concentrations to full copper concentration ratio ranging from 73 percentage to 97 percentage. Based on modeling completed later the 2014 drilling program, the deposit is interpreted to be open to the westward.

In belatedly 2014, Copper Fob appear the results of in-situ pressure level leaching tests on samples of the oxide copper mineralization from the Van Dyke eolith. The objectives of the test work were to evaluate copper dissolution kinetics, full soluble copper extraction (recovery), acrid consumption and to simulate the underground hydraulic pressure in an in-situ leaching process. The exam work indicated that approximately 89 percent of the copper contained in the samples reports as soluble copper with copper extractions averaging 63 pct over a 120 day leach period.

In 2019, Copper Fox commenced a program to re-analyze all historical pulp samples and selected cadre intervals. The objectives of the plan were to define the total extent of the soluble copper envelope for the Van Dyke deposit and to update the geological model for the project. Initial results show a 29 pct increase in acrid-soluble copper concentration and thicker mineralized intervals when compared to the project'south original database.

The results from the analytical program and an updated geological model course the basis for the updated resources judge for the Van Dyke deposit. Copper Flim-flam retained Moose Mount Technical Services to complete the updated resource judge, which was released in March 2020. Highlights from the resources judge include:

- An indicated resource of 97.6 meg tonnes, grading 0.33 percent total copper and 0.24 percent full recovered soluble copper containing 717 million pounds of total copper and 517 one thousand thousand pounds of recoverable soluble copper

- An inferred resource of 168.0 million tonnes, grading 0.27 percent total copper and 0.19 per centum total recovered soluble copper containing ane.0 billion pounds of total copper and 699 million pounds of recoverable soluble copper

The 2019 re-assay program conducted past Copper Fox and updated geologic estimation resulted in a significant increase in contained soluble copper within the Van Dyke copper eolith when compared to the previous 2015 estimate. The mineralized envelope of the Van Dyke copper eolith is open to the south and southwest. Moving forwards, the company intends to keep to explore the property in order to define unknown zones of mineralization.

"The 2019 work programme has increased the conviction level in the project resource and significantly increased the recoverable soluble copper content of the Van Dyke eolith. The 2019 review of historical exploration data combined with the current resource interpretation, indicates the eolith could be open up to the southward and southwest with a possible strike extension of between one and 2 kms. Additional drilling volition exist required to realize this potential and to define the un-explored portions of the Van Dyke deposit," said Stewart.

Mineral Mountain Copper Project – Arizona

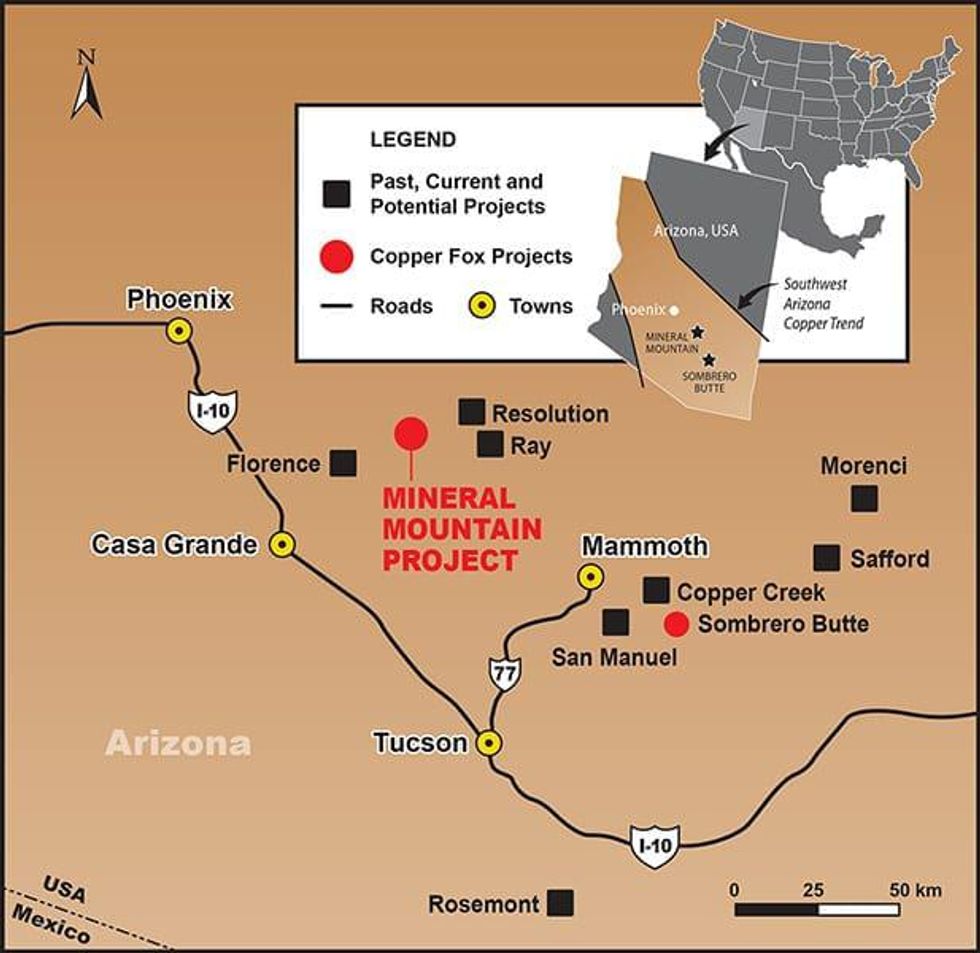

Copper Fox has 100-per centum buying of the 4,905-acre Mineral Mountain copper projection located east of Florence, Arizona. The Laramide porphyry copper province in Arizona is 1 of the most prolific copper mineralized districts in the globe. The World-Miami, Resolution, Florence and Casa Grande copper districts are located in primal Arizona and occur along a northeast trend. The Mineral Mount copper project is located on this trend between the Florence and Resolution copper deposits.

"The discovery of new porphyry copper districts in geopolitically stable areas is fundamental to the future of the copper industry," explained Stewart. "The Mineral Mount project exhibits the surface characteristics of a cached porphyry copper deposit and provides Copper Fox considerable exposure to copper exploration in the Laramide porphyry copper province of Arizona in an easily accessible location."

Historical Exploration

Historical exploration for the project includes bulldozed trenching and an Induced potential geophysical survey (1971) completed within a three,000-foot past two,000-foot area of copper +/- molybdenite mineralization hosted in a Laramide historic period quartz monzonite intrusion.

"The review of a number of historical exploration reports has significantly advanced our understanding of the property and focussed the 2018 exploration program," said Stewart. "The porphyry copper target is hosted in a Laramide historic period quartz monzonite, the main host rock for porphyry copper deposits in Arizona. The precious metal targets were previously mined for higher-grade gold-silverish-base metal mineralization. Based on our review, the area does not appear to accept been explored for lower-grade precious metallic mineralization."

Ongoing Exploration

Between 2015 and 2018, Copper Play tricks identified ii large areas of porphyry-style copper-molybdenum-gold mineralization on the property. The first target known every bit Surface area one, hosts approximately 600 copper showings in outcrops over a iv,500-meter-long by up to two,000-meter-broad surface area in that portion of the quartz monzonite stock along the contact with the Precambrian Pinal schist. The principal copper minerals are malachite, chrysocolla, chalcocite every bit well as rare covellite and chalcopyrite occur as disseminations, in quartz veinlets and along fractures primarily hosted in potassic and phyllic-altered Laramide age quartz monzonite. Within the area of copper mineralization, three zones of disseminated copper-molybdenum mineralization occur; the largest of which measures approximately one,000 meters long past 350meters to 450 meters wide with concentrations of up to 0.2 percent molybdenum. The copper mineralization correlates with a positive chargeability and resistivity anomaly (1,800 meters by 900 meters) outlined in 1971. The molybdenite mineralization ("B" veins – porphyry terminology) and spatial distribution of the different styles of copper mineralization advise an outward progression from the cadre of a porphyry system.

The copper mineralization in Area 2 occurs over an surface area that measures 2,800 meters long, averages 400 meters wide and is characterized past quartz vein and fracture-controlled copper mineralization in Laramide age dikes and Precambrian age Pinal schist, diabase and granite. The copper mineralization in Surface area two contains significantly lower concentrations of molybdenum than Area one. The lower molybdenum concentrations and unlike styles of copper mineralization are interpreted to reflect the depth to the potential porphyry stock.

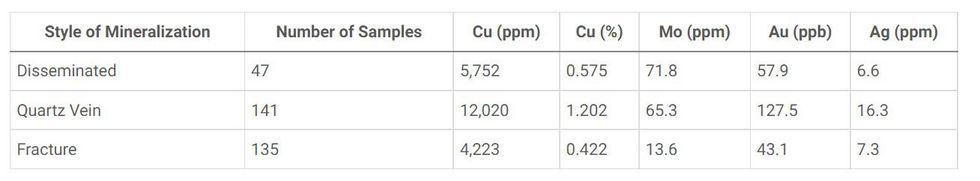

The average metal concentrations of the three styles of copper mineralization in Area ane and Area 2 are shown below.

Average Concentration

The 2018 stone scrap sampling programme was completed over the two target areas to narrate the mineralized structures exposed in outcrops. The sampling program returned values of up to 10.38 percentage copper and 0.208 percent molybdenum in Area ane.

Sombrero Butte Project – Arizona

The two,913-acre Sombrero Butte projection is located in the Bunker Loma mining district in the Laramide porphyry copper province in Arizona; 1 of the most prolific copper mineralized districts in the world. The projection is located on a trend that hosts large porphyry copper deposits such every bit the San Manuel-Kalamazoo, Ray and Copper Creek deposits. The region is a well-known mining jurisdiction with splendid and readily available infrastructure. The property is 100-percent endemic by Copper Flim-flam. During the early 1900s, copper mining activities were conducted within the holding with Magma Chief being the largest mine in the district.

Exploration Activities:

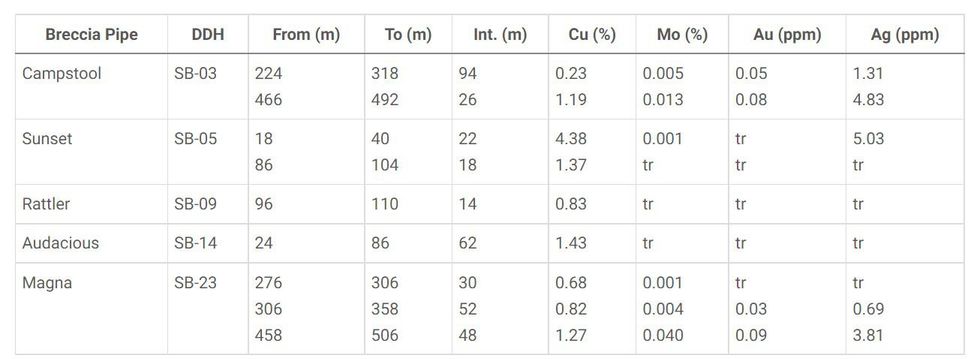

Mineralized breccia pipes commonly represent the surface expression of buried porphyry copper deposits in Arizona. Between 2006 and 2008, Bong Copper Corp. (TSXV:BCU) completed 34 diamond drill holes testing seven mineralized breccia pipes located at the north terminate of the belongings. This program yielded significant copper mineralization. Selected mineralized intervals from the Bong Copper drilling are listed beneath:

The mineralized intervals listed in the above table do not represent truthful widths.

Copper Fox purchased the project in 2012 and completed surface exploration which identified two surface exploration targets.

Copper Play tricks commissioned a Titan-24 DCIP survey in July 2015, and the results of the IP survey support the interpretation of the presence of a buried porphyry copper system. The chargeability signature exhibits a strong positive correlation with the alternation, mineralization and copper-molybdenite geochemical anomalies outlined in 2013 too as the mineralized breccia pipes and historical drill results.

Two large porphyry copper targets have been identified on the property. At the south end of the property a ii,000-meter-long porphyry copper target consisting of copper-molybdenum geochemical anomalies, copper-molybdenite veins, associated potassic and argillic alteration, pyrite veining (at present limonite) and 40 mineralized breccia pipes, of which only six have been drill tested. Inside this target, at least 12 breccia pipes show intense dickite alteration—an indicator mineral of advanced argillic amending, an alteration that occurs in many of the region's porphyry copper deposits, including BHP Group PLC'south (LSE:BHP) San Manuel-Kalamazoo eolith.

Copper Fox released the results of a study completed in October 2016 on the chemistry of six hydrothermal breccia pipes within an area that measures 300 meters by 400 meters at the north cease of the Sombrero Butte projection. The remaining 18 hydrothermal breccia pipes at the due north cease of the property and hydrothermal breccia pipes located in the centre of the property were not included in the study due to the lack of geochemical data.

"This study supports the presence of a cached porphyry system and shows that the breccia pipes acted equally a pathway for a circuitous multi-phase introduction of metals," said Stewart. "In addition to the pipes that comprise significant concentrations of copper-molybdenum-aureate-silver mineralization, the lesser 500-meter interval of diamond drill hole SB-23 is interpreted to accept intersected the outer portion of a porphyry system commonly referred to every bit a 'pyrite shell.' The fact that the 2015 Titan-24 DCIP survey mapped the mineralized breccia pipes has advanced our interpretation of other chargeability anomalies inside the property."

The 2016 study focused on trace elements, such every bit molybdenum, golden, silver, arsenic, antimony and tungsten, elements that are commonly associated with a porphyry copper system. While analytical results for copper were previously announced by Bell Copper, the results for molybdenum-gold-silver and associated elements had non been previously announced.

A mapping and sampling programme is planned to commence in the near term on the Sombrero Butte property. The program is expected to focus on the surface expression of the large chargeability and resistivity anomaly located in the s-central portion of the holding. Copper Fox is looking for vein types, alteration and distribution of copper-molybdenite mineralization in this area.

District Copper Investment

Copper Pull a fast one on owns 24.4 percentage of the issued and outstanding shares of Commune Copper (formerly Carmax Mining Corp.). Looking to capitalize on the ascent gold prices, Commune Copper picked up assets in the gilded exploration space in 2018. District Copper now has ii properties in its portfolio: the Stony Lake gold project and the Eaglehead copper-molybdenum-gold-argent project.

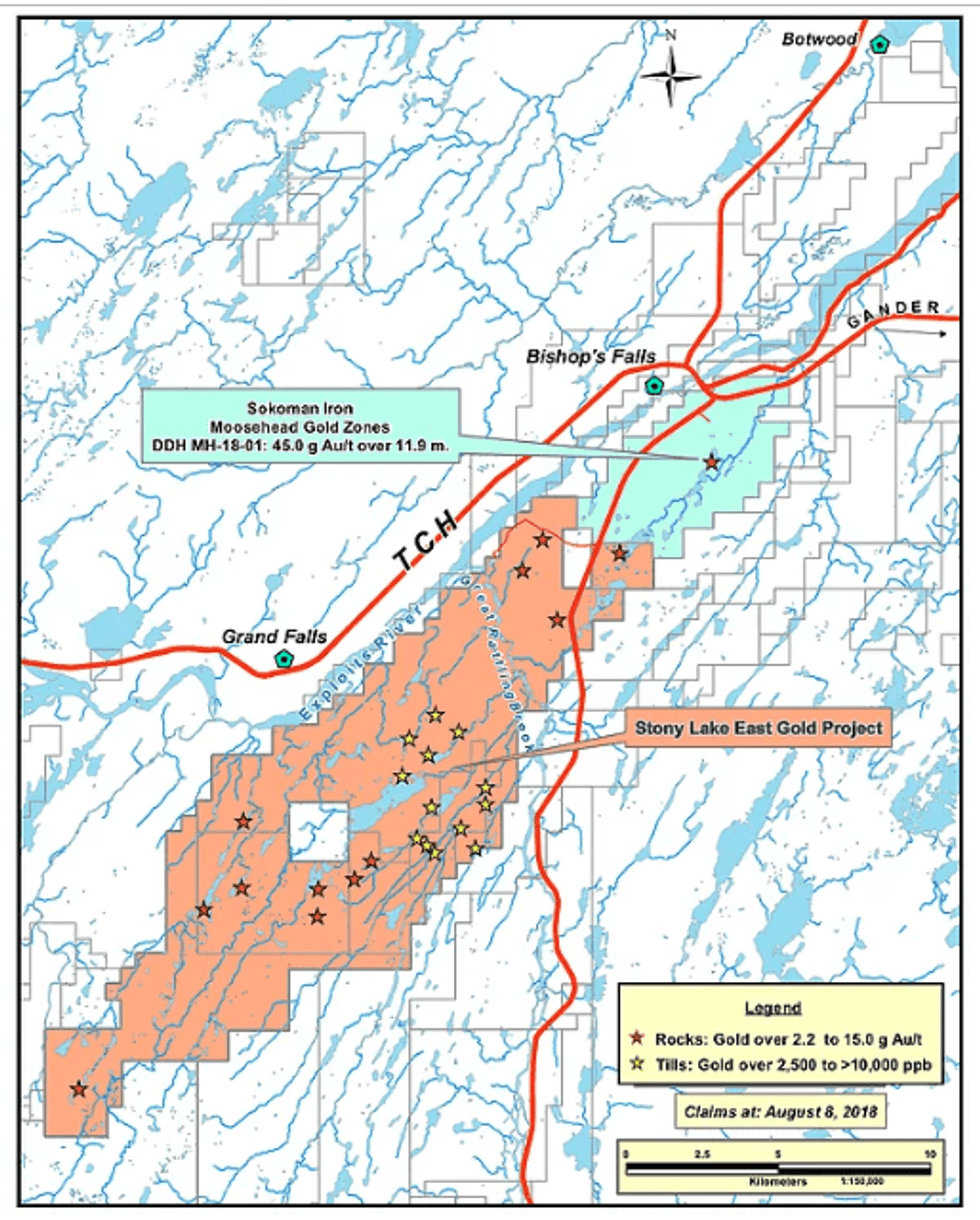

Stony Lake Project – Newfoundland

The 13,025-hectare Stony Lake gold projection covers a 27-kilometer portion of the Cape Ray-Valentine Lake Structural trend in central Newfoundland. This expanse is role of Canada's newest emerging orogenic gold district. The region hosts several recent high-form golden discoveries including Sokoman Iron Corporation's Moosehead discovery, Antler Gold Inc.'southward (TSXV:ANTL) Twilight zone and Marathon Gold Corp.'southward (TSX:MOZ) Valentine Lake golden deposit. The Stony Lake property is located between the Twilight and Moosehead discoveries.

Post-obit the conquering of the Stony Lake project, Commune Copper expanded the size of the Stony Lake project by acquiring the Duffitt and Island Pond gold projects which are contiguous with or adjacent to the Stony Lake projection.

Exploration

In 2019, prospecting and sampling (286 samples) and mapping of lithologies, alterations, and styles of mineralization was completed. Selected samples were collected from outcrop, sub crop and large athwart boulders (close to bedrock) to narrate the precious and base metals and trace chemical element geochemistry present in veins, other mineralized structures and outcrops.

An airborne geophysical survey was completed in August 2019. The compilation and estimation of the geophysical results are in progress.

The 2019 program outlined eight areas of anomalous to low-form gold mineralization (greater than 50 to 4,026 ppb). The gold mineralization is hosted in pyrite and arsenopyrite bearing quartz-feldspar porphyry, reduced sandstone, quartz stockwork and quartz veins, characterized by varying intensities of sericite, silica, ankerite, carbonate and chlorite amending typically as pervasive alteration and envelopes effectually quartz stockwork, quartz veins. The mineralization exhibits arsenic-antimony-molybdenum geochemical associations.

The parameters that characterize the anomalous to low-course golden mineralization located on the Stony Lake property advise the potential for a sediment-hosted intrusion-related gold environment. Sediment-hosted intrusion-related aureate mineralization is characterized by faulted and folded siliciclastic rocks, granitic intrusions, regional-scale faults, sericite with late carbonate alteration, mineralization hosted in sheeted veinlets, stockwork, disseminated and vein swarms with gold, silver, bismuth, tungsten and molybdenum geochemical associations.

The zones of dissonant to depression-grade gilded mineralization are located along an interpreted northeast-southwest trending corridor located in the western side of the holding. Sampling to the west and due east of the interpreted corridor returned low (less than 20 ppb gilt) concentrations of gold. Information technology is expected that the results of the airborne survey should provide insight into the structural control if any of these areas of anomalous to depression-class gold mineralization.

Eaglehead Project—British Columbia

The 15,956-hectare Eaglehead copper-molybdenum-gilt-silver project is located in the Laird mining district in northern British Columbia. The project is currently on care and maintenance.

Exploration

Between 2014 and 2018, District Copper re-logged 94 historical diamond drill holes, completed airborne and ground geophysical surveys, preliminary rock characterization exam work and drilled six holes to test the continuity of the East, Bornite and Pass zones. The company likewise sampled, re-sampled and re-analyzed 22,697 meters of drill core from 99 historical drill holes. In 2018, Commune Copper completed the re-logging, sampling and resampling work required to eliminate "legacy data" issues relating to the Eaglehead project.

In 2017, Copper Play tricks released a NI 43-101 technical report on the Eaglehead project. The report recommended that C$iv.95 meg is warranted to evaluate the potential of the project.

Preliminary Metallurgical Testing

Preliminary flotation test work on mineralization from the Eaglehead deposit indicates about 88 percent copper, 74 percent gold, 72 percent silver and a minimum of 55 percent molybdenum recoveries into a clean 28-36 percentage copper concentrate.

Management Team

Elmer B. Stewart, P.Geol, MSc. – Chairperson of the Board, President and CEO

Elmer Stewart has over 42 years of domestic and international experience in mining and exploration for gold, uranium, base of operations metals and copper. During his career, he has been involved in the financing and conquering of a number of base of operations metal and gold projects besides the development and construction of two underground mines and the structure and functioning of three open pit aureate mines. With approximately xxx years of feel at the senior management level for diverse companies listed on the TSX and TSXV, he is currently the Chairman, CEO and President of Copper Fox Metals Inc., Chairman of Commune Copper Corp. and is a Director of Liard Copper Mines Ltd. Stewart is Copper Fob'south representative on the Management Committee for the Schaft Creek Joint Venture

Braden Jensen, CA, B.Comm. – Master Financial Officer

Braden Jensen is a chartered auditor with a bachelor of commerce degree from the Academy of Victoria. Jensen began his career and training with KPMG LLP. He was in the public practice sector for half-dozen years, concentrating in commodities-based accounting and tax prior to inbound the resource sector where he has been responsible for reporting on exploration and operations.

Hector MacKay-Dunn, Q.C. – Director

Hector MacKay-Dunn is a Senior Partner at Farris, Vaughan, Wills & Tater LLP where he advises private and public high-growth companies in a broad range of industries on domestic and cross-border private and public securities offerings, mergers and acquisitions, tender offers and international partnering transactions. MacKay-Dunn is recognized by Lexpert, a respected Canadian legal publication, equally being among the acme 100 Canada/United states cross-border corporate lawyers in Canada and amongst Canada's leading lawyers in mergers in acquisitions, technology and biotechnology. Appointed Queen'due south Counsel in 2003, he holds the highest (AV Pre-eminent) legal ability rating from Martindale-Hubbell, an administrative and global source for identifying leading lawyers and constabulary firms, and the Best Lawyers in Canada ranks him equally a national leader in technology and biotechnology.

Michael Smith – Director

Michael Smith has been a director of Copper Pull a fast one on Metals since September 2004 and was Executive Vice-President until his retirement in September 2013. Smith had a 38-year banking career with RBC Purple Depository financial institution, belongings senior management positions in Calgary, Edmonton, Montreal and New York. Mr. Smith is currently a Managing director and a member of the Audit Committee for Copper Fox, a Director and Chairman of the Audit Commission for Commune Copper as well as a Director and Treasurer of a registered public charity.

Ernesto Echavarria, CPA – Director

Ernesto Echavarria is a Certified Public Accountant and has extensive feel both at the executive and lath levels of big corporations. He is a significant investor with a number of major corporations in United mexican states including MegaCable Property Sab, a controlling shareholder, and is an executive and Director of Franks Distributing, a major international distributor of fruits and vegetables. Echavarria is also an investor and Manager of numerous other entities, including mining companies.

Erik Koudstaal, CA – Director

Erik Koudstaal is a Canadian Chartered Accountant and a retired partner of Ernst and Young. His bookkeeping career spans forty plus years in Holland, Canada, Africa (Nigeria), Asia (Singapore), Europe (Spain) and the The states. Koudstaal retired from Ernst and Young's New York International part in 2001. His multinational clients were in natural resources, cyberbanking, manufacturing and engineering science. Since retiring, he has been a fiscal consultant and a Board Fellow member (Treasurer) of 2 organizations. In January 2008, Koudstaal completed the Governance Essentials Program for Directors (not-for-profit) at the Institute of Corporate Directors and the Rotman School of Management, University of Toronto.

Source: https://investingnews.com/copper-fox-announces-2022-first-quarter-operating-and-financial-results/

0 Response to "This Project Is a Review of the Accounting Cycle That Has Been Covered During Class"

Post a Comment